Each year, the Student Banking Survey reveals how students really feel about their banks, BNPL services, cash payments and much more. Read on for the full results of this year's survey.

Credit: fratello – Shutterstock

Now in its eighth year, the Student Banking Survey reveals all about how students manage their money.

We asked over 1,200 UK students about banking, borrowing, cash, Lifetime ISAs (LISAs) and buy now, pay later (BNPL) payment services. From their responses, we're able to provide a very interesting insight into how UK students truly feel about bank accounts and financial products.

What's in this report?

- Key findings

- How do students choose a bank

- Do students consider switching banks?

- What is the most popular bank among students?

- Student satisfaction with their banks

- Use of cash among students

- Student borrowing habits

- What do students think about BNPL services?

- How many students have Lifetime ISAs (LISAs)?

Our latest National Student Money Survey takes a detailed look at students' spending habits and living costs, as well as their honest views on Student Finance.

Key findings from the Student Banking Survey 2022

Here's an overview of the key findings from this year's Student Banking Survey:

- Santander is the most popular bank among students.

- Only 12% of students are looking to switch bank accounts.

- 10% of students never use cash.

- Among students that have overdrafts, over a quarter have hit their limit at some point, and nearly half are unsure when they need to pay it back.

- One in five students have a LISA.

- 5% of students use BNPL sites often, and a further 17% use them sometimes – however, many express strong concerns about them.

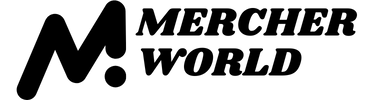

How do students choose a bank?

When choosing a bank for university, two in five students in the survey chose to stay with the one they were already with, while just under a third got recommendations from their friends and family.

Over the last few years, we've seen a steady decline in the proportions of students who are influenced by freebies and discounts when choosing a student bank account.

In our 2020 banking survey, 31% said they chose a bank based on the freebies. This went down to 30% in 2021, and it's now decreased further to 27% in 2022.

Alongside this, there's been a noticeable increase in the proportions of students who prioritise online or app access when choosing a bank. In 2020, 20% of students surveyed said they chose a bank based on this, which went up to 21% in 2021, and has jumped up further to 25% this year.

As we cover in more detail below, over the last few years, we've seen a gradual increase in the proportions of students using app-based bank accounts like Monzo.

For traditional banks to maintain their popularity among students, our findings suggest there's a growing need for them to provide advanced app-based banking features that compete with the leading branchless banks.

Freebies are still important to 27% of students in the survey. However, without well-optimised and accessible banking apps, our surveys indicate that traditional banks could find it increasingly difficult to appeal to new students in the coming years.

Where do students do bank account research?

| Type of research | How many used this method |

|---|---|

| Online | 80% |

| Parents | 37% |

| Friends | 29% |

| Bank | 16% |

| University or SU | 7% |

| School | 4% |

| Other | 1% |

As we've seen in previous banking surveys, the vast majority of students look online to research bank accounts.

Only 4% of students in the survey got advice from their school. But, some felt as though young people should get more info about student banking before starting uni:

- [We] could do with sixth forms educating students before the end of school life.

- Students should be taught more in school about student bank accounts including what [overdrafts] and interest rates mean.

- Banks should do outreach work in colleges and sixth forms to help teach students how to read statements and how to stop standing orders, etc.

- More should be told about it before going off to uni.

The basics of personal finance, such as how interest rates work and what to look for in bank statements, are some of the key money lessons that should be taught in schools.

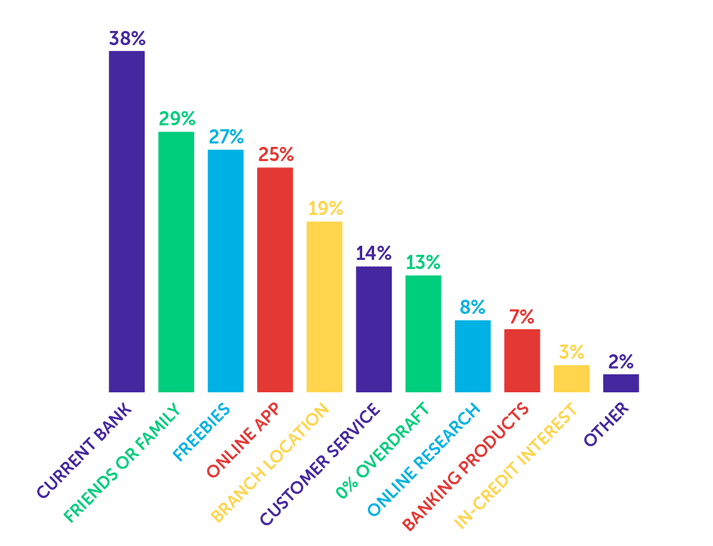

Do students consider switching banks?

When it comes to bank accounts, loyalty doesn't tend to pay off – it's usually new customers who receive the best deals. Because of this, it's a good idea to keep an eye on what freebies other banks are offering to people who switch over to them.

Switching banks is a great way to get free money, as banks often offer around £100 as a sign-up offer to new customers.

However, despite this, just 12% of students in the survey said they're looking to switch bank accounts.

Keeping in mind that the most common reason why students chose their account was to stay with their current bank, loyalty and/or convenience seem to be big factors in their banking choices.

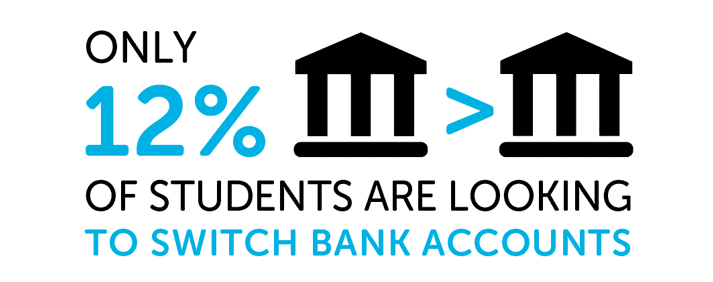

What is the most popular bank among students?

Since we began running our Student Banking Survey in 2015, Santander has consistently been the most commonly used student bank account. This is likely due to their competitive overdrafts and generous sign-up incentives (they currently offer a 16–25 Railcard that lasts for four years).

However, we've noticed a slight shift in students' banking choices over the past few years. As we touched on earlier, app-based banks are becoming increasingly popular.

55% of people in the survey said they have a student-specific bank account, which is down from 59% who'd said the same last year.

App-based banks

The 2021 banking survey was the first time we'd seen an app-based bank be used by a higher proportion of students than a traditional bank. Monzo was being used by 2% of students in that survey, overtaking the 1% that used TSB at the time.

This year, there's been a further increase, with 3% of surveyed students now saying they use Monzo as their main bank account.

It's worth noting that there have also been slight increases in the proportions of students using Revolut and Starling.

In 2021, 1% said they used Revolut, and another 1% used Starling. In this year's survey, both of these figures have increased to 2%.

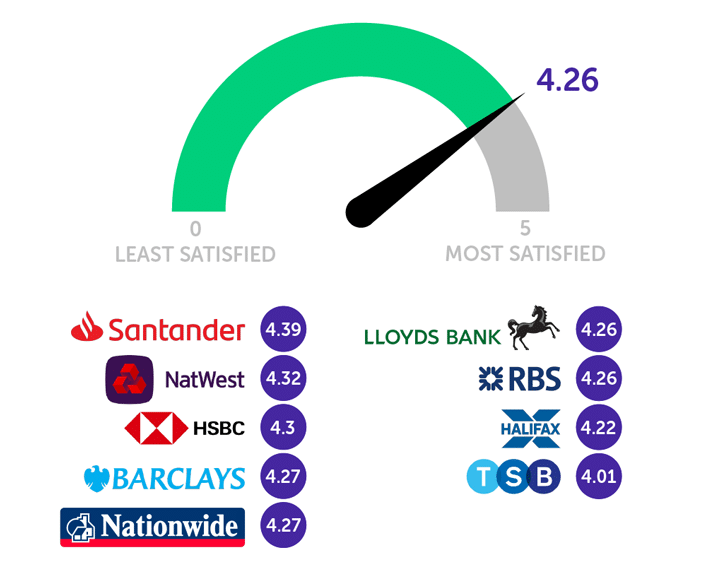

Student satisfaction scores

On the whole, students are pretty satisfied with their banks, giving their accounts an average score of 4.26 out of 5.

However, this is down slightly, as the average score in both 2020 and 2021 had been 4.31.

Here, we've focused on the scores of banks that offer student-specific accounts.

However, Monzo received an impressive average score of 4.41 out of 5 from its users, despite not offering a student bank account. This again highlights how important app banking features can be for students.

How often do students use cash?

As many as one in 10 students in the survey never use cash. On top of this, 38% use cash once a month or less. This means that nearly half are rarely using cash, if at all.

Having said that, some students do use cash regularly. 4% said they use cash once a day, and a further 4% said they use it more than once a day.

But, as the contactless payment limit is now £100, most purchases can be made with just a tap of a card.

On top of this, the growing popularity of banking apps could also eliminate some students' need for cash. Mobile payments are extremely convenient.

Over the coming years, it will be very interesting to see how students' use of cash changes.

Student borrowing habits

When looking into students' borrowing habits, we've mostly focused on two main areas: overdrafts and buy now, pay later (BNPL) payment services.

How overdrawn are students?

| Size of overdraft | Students overdrawn by this amount |

|---|---|

| Not overdrawn | 74% |

| £99 or less | 7% |

| £100 – £499 | 6% |

| £500 – £999 | 5% |

| £1,000 – £1,999 | 5% |

| £2,000 and over | 1% |

| Rather not say | 2% |

Around three quarters of students in the survey told us they weren't overdrawn at all, and 13% were overdrawn by less than £500.

It's important to recognise that overdrafts can be beneficial to students if used carefully.

Student bank accounts offer fee- and interest-free overdrafts. So, if students use their overdraft as a buffer that helps them get by until their next loan instalment, it can be useful.

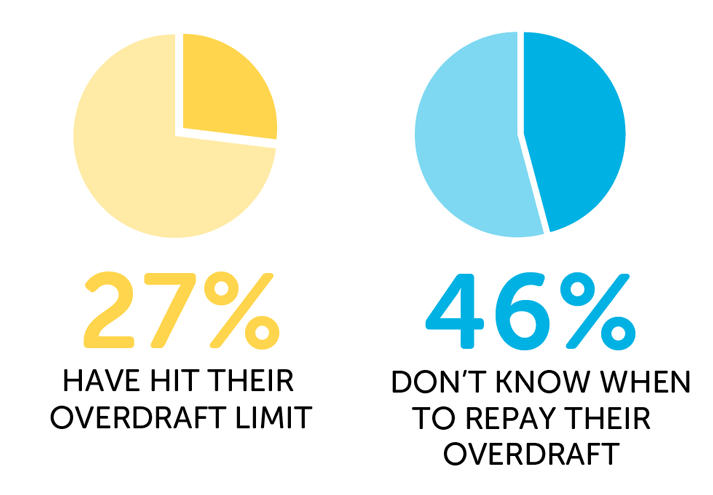

However, for overdrafts to be used safely, it's essential that students are fully aware of the borrowing terms and that they stay comfortably within the limit.

Unfortunately, our survey found this is too often not the case.

Among students who have overdrafts, 27% have hit their limit at some point and 46% don't know when they need to repay their overdraft.

Both of these figures are up slightly from last year, when 24% of students with overdrafts had said they'd hit their limit, and 45% didn't know when to repay it.

How many students use buy now, pay later services?

In recent years, we've noticed a growing proportion of students using buy now, pay later (BNPL) sites like Klarna, Clearpay and PayPal Credit.

While 5% of students in the survey said they use BNPL often, a further 17% said they use it sometimes.

Interestingly, the same proportion of students in last year's banking survey said they used it often, but only 14% had said they used it sometimes. So, although it's a small change, there has been a slight increase this year.

But, despite this, students have very mixed views about buy now, pay later payment services. Here are some of the comments we received about BNPL in the survey:

- Easy way to pay for things while I wait for Student Loans to come in.

- A slippery slope.

- A good idea for people who don't get a lot of money straight away, but could lead to financial issues [if] unexpected money problems come up.

- Dangerous, fuelling consumption and living on credit.

- I think they can be extremely enticing for students but essentially it's a loan which you have to pay off.

- I love them.

- Bad trap for debt.

- They are a good idea especially with clothes that you have to try on and decide if they fit/look good, it makes them easier to return.

- They are convenient if you are able to pay the money back without issue, however it can get addicting and if someone has bad money management it can be a hard mission to get out of.

As we know some of our readers use Klarna and similar buy now, pay later sites, we did some research to find out: is Klarna safe?

How many students have Lifetime ISAs (LISAs)?

Lifetime ISAs (LISAs) are similar to Help-to-buy ISAs (which are no longer available to new customers). They can be used to buy a first home or for retirement.

You can save up to £4,000 a year with a LISA. Every financial year (April–April), the government pays a 25% bonus on the amount saved, meaning you could receive up to £1,000 for free each year.

LISAs are generous saving schemes, but surprisingly, 32% of students in the survey didn't know what they were. 18% had one, and the remaining 50% were aware of them but had not yet opened an account.

To find out more and see our list of the top providers, take a look at our full guide on how LISAs work.

About the Student Banking Survey 2022

- Source: Student Banking Survey 2022 / www.savethestudent.org.

- The survey polled 1,243 students in the UK between 24th March and 11thApril 2022.

- Data from our previous surveys can be found here.

- Save the Student's Press Page.

- Tools and resources.