With energy bills on the rise, our latest accommodation survey arrives at a time when student renters are facing significant and immediate financial challenges.

Credit: Monkey Business Images, fad82 – Shutterstock

Now in its sixth year, the National Student Accommodation Survey 2022 asked over 1,200 students about the realities of dealing with student accommodation problems – particularly when faced with soaring energy prices on top of monthly rent.

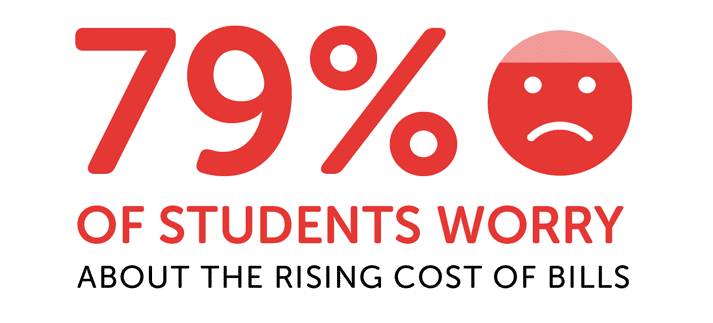

Among students in the survey who pay bills, four in five said they're worried about the rising costs. But, unfortunately, the government's support package has failed to effectively take a vast number of students' living situations into account.

In fact, from our calculations, we estimate that current students could end up being over £100 million worse off compared to those eligible for the full support package.

We'll explore this, and much more, below.

What's in this report?

- Key findings

- Where do students live during term time

- How much does student housing cost?

- The rising cost of energy bills

- How do students pay their rent?

- The biggest housing issues for student renters

- What do the experts say?

Key findings

Before we unpack the results in more detail, here's a quick overview of the key findings from the National Student Accommodation Survey 2022:

- We estimate that full-time students will miss out on over £40 million of support as they're not eligible for the £150 council tax rebates. To make matters worse, we predict that they will end up repaying about £60 million more than they'll save from the £200 bills credit in October.

- These combined could lead current students to experience a £100 million shortfall compared to those eligible for the government's full support package.

- Four in five students who have energy bills are worried about the rising costs, while three in five have already noticed their bills increase due to the energy crisis.

- Due to the rising cost of energy, students in the survey who don't have bills included in rent anticipate cutting back on socialising (54%), groceries (43%), travel (42%) and more.

- Students spend an average of £148 per week on rent. Worryingly, one in 10 that pay rent describe keeping up with the cost of it as a constant struggle.

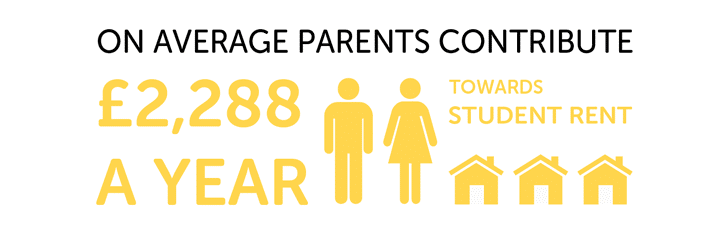

- Parents contribute an average of £2,288 a year towards their child's rent at university.

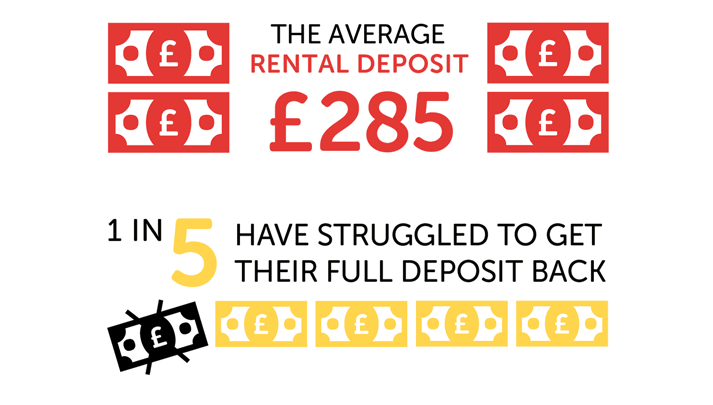

- £285 is the average rental deposit for students, but one in five have struggled to get their full deposit back.

- The most common housing issue for students is a lack of water or heating, which has affected 30% of those in the survey.

- A third of students view their accommodation as poor value for money.

Where do students live during term time?

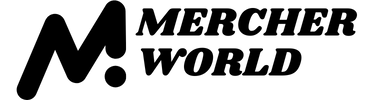

With the coronavirus restrictions no longer having quite the same impact on students' living situations as they did last year, we've looked into whether there have been any noticeable changes in where students choose to live.

In the 2020/21 academic year, we saw a significant shift in more students moving in with their parents due to the pandemic. As many as 35% of students in the National Student Accommodation Survey 2021 said they moved back in with their parents or guardians during the year.

This year, the majority of students in the survey live in properties with a private landlord or in university accommodation. However, we have identified a slight shift in the proportion of students choosing to live with their parents or guardians.

At first glance, it appears as though there has only been a slight change in the proportion of students living with their parents or guardians this year compared with last year. At the start of 2020/21 (before lockdowns led many to move back home), only 10% of students were living with their parents. This has increased slightly to 13% this year.

It's really when we break down the figures by university year groups that the change is most noticeable. Second- and third-year students, in particular, are more likely to live at home with their parents this year compared to last year.

| Students living with parents/guardians | 2021 survey | 2022 survey |

|---|---|---|

| First-year students | 10% | 12% |

| Second-year students | 10% | 16% |

| Third-year students | 9% | 15% |

There is still a change among first-year students, but the increase is not quite as marked.

It could be that some second- and third-year students moved back in with their parents or guardians due to the COVID restrictions last year and discovered the benefits of it compared to renting. There's also the potential that some were concerned about moving to uni, only to discover the majority of their classes would be taught online again.

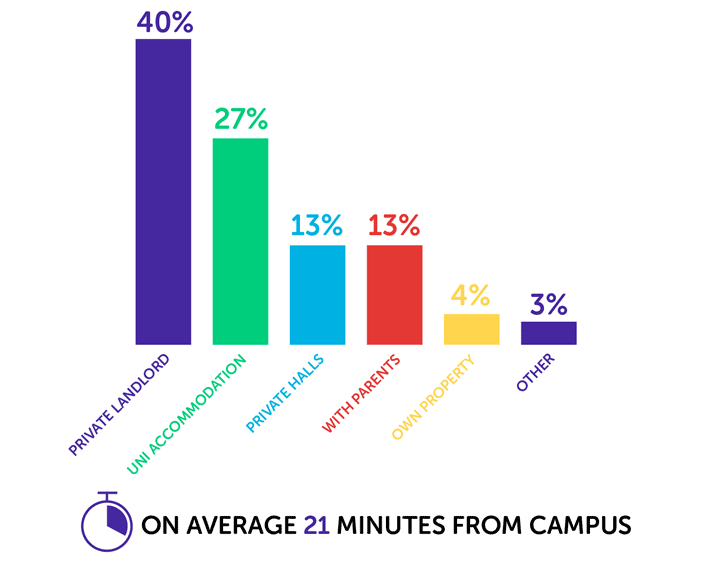

When do students look for accommodation?

For those who are planning to move to a new house or flat next year, the autumn and winter months are the most common times to view properties.

Here's an overview of when students in the survey have looked, or plan to look, for new accommodation:

Have students signed rental contracts for 2022/23 yet?

30% of students in the survey said that they'd started looking for accommodation by December 2021. However, not all of them had yet signed their next rental contract at the time of answering the survey in January – February.

When we asked students if they have signed their tenancy agreement for next year's accommodation, this is what they said:

- 41% – Haven't signed their next contract, but will do

- 33% – Haven't signed their next contract, and aren't planning to

- 26% – Have signed their next contract.

For any students who are planning to rent next year but haven't yet signed a tenancy contract, it can help to request a break clause. This would give you the right to end a tenancy early if you need to.

How much does student accommodation cost?

Among students in the survey who paid rent, the average amount they paid each week was ever so slightly higher than last year, up from £146 to £148.

It may sound like a small increase, but when we consider that the average student tenancy length is around 10 months, this equates to an increase of about £87 a year.

6% of students in the survey said they are currently in rent arrears. The average amount owed by these students is £635, so any increase is inevitably going to put a further strain on their finances and increase their risk of eviction.

It's very worrying to think of any students facing eviction, but unfortunately, 5% of students in the survey (up from only 1% last year) have previously been evicted due to unpaid rent.

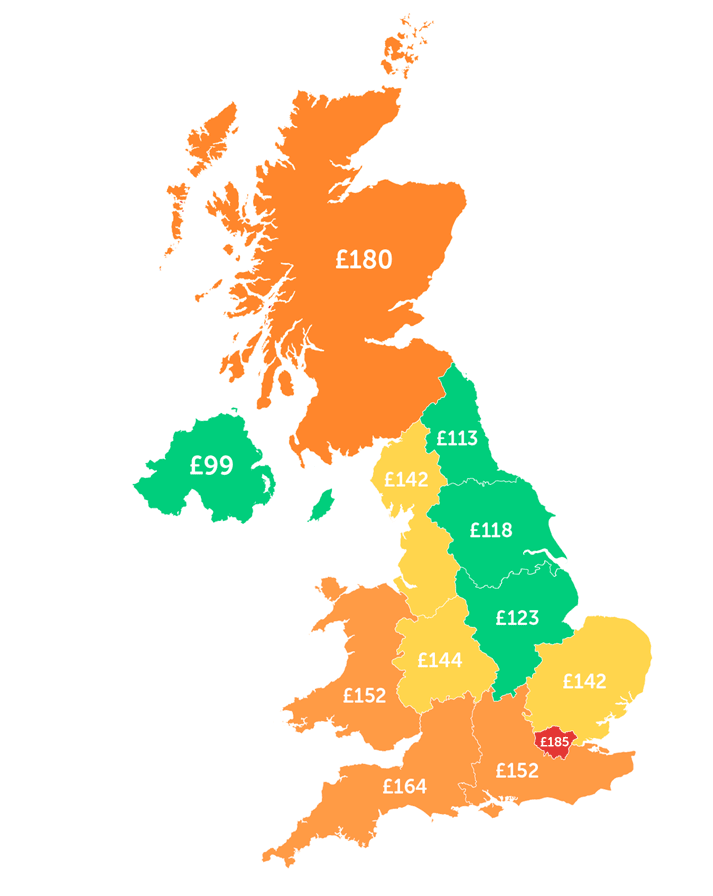

Student rent in each region of the UK

Around the UK, average student rental prices vary widely, from £99 per week in Northern Ireland to £185 per week in London.

While London is predictably the most expensive part of the UK for students to live in, it's surprising to see that the average cost of student rent in Scotland is nearly as high (£180 per week).

It's worth noting that, out of the survey respondents who lived in Scotland, almost half were in Edinburgh which will have impacted the average figure.

As rent in Edinburgh is generally higher than elsewhere in Scotland, it won't necessarily be reflective of the whole country. But, it nonetheless highlights that some students are missing out on the increased Maintenance Loans offered to students in London, despite paying nearly as much in rent.

We asked students in the survey whether they believed student accommodation costs should be kept in line with Maintenance Loans, and 80% agreed they should.

For those trying to keep up with the cost of rent, is the Maintenance Loan big enough? This is what some students in the survey told us:

- As a student on the lowest Maintenance Loan, it does not cover my accommodation so I have to work a lot every summer and holidays [and] part-time at uni to make ends meet, as well as going into my overdraft. (Uni halls)

- As my Maintenance Loan doesn't cover my accommodation fully, I have to have a job to pay for food, etc. (Private halls)

- I am lucky enough to have enough Maintenance Loan to cover my rent. I just have to work to cover food and extra expenses. (Uni halls)

- My Maintenance Loan is a LOT less [than] rent anywhere and [I've] been turned away from jobs because they said they don't want uni students. (Private landlord)

Which accommodation is cheapest?

Based on responses to the survey from students who live in university halls, private halls or in a property that has a private landlord, this is how much their rent costs on average:

| Accommodation type | Average weekly rent |

|---|---|

| Uni accommodation | £147 |

| Private halls | £151 |

| Private landlord | £153 |

You may notice that a couple of the figures in the table are higher than the average overall figure of £148 per week that we mentioned above. This is because the overall figure is an average among all students that pay rent, which can include those who live with parents/guardians or live in other forms of accommodation.

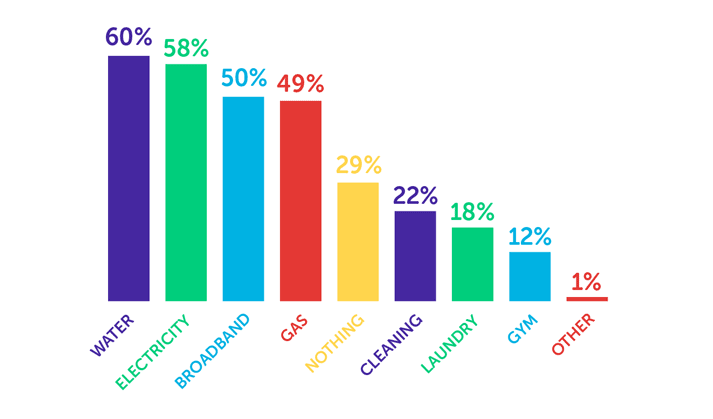

What do students get for their money?

Here's what students have included in their rent:

As we'll explore in more detail later, the rising cost of bills is weighing on the minds of many students.

As we'll explore in more detail later, the rising cost of bills is weighing on the minds of many students.

It's important to note that around 60% of students have electricity and/or gas included in their rent. This leaves the remaining 40% needing to pay at least some energy bills each month.

What else do students need to pay for?

With the average rental deposit costing students £285, it's concerning that around one in five in the survey (19%) who have had a deposit have found it hard to receive theirs back in full.

We encourage students to read their tenancy agreements in detail to ensure they understand the contract and can avoid the risk of losing their deposit unnecessarily.

28% of students in the survey didn't personally read their tenancy agreement before signing it. However, this figure is slightly down from last year, when 31% hadn't personally read theirs.

Among those who didn't personally read their tenancy agreement, 14% said their parents did, while 6% said their friends/housemates did. 8% said that nobody read the contract before they signed it.

We heard from some students in the survey about how far their rent goes:

- Living with parents because renting and halls were both horrific experiences and not value for money. (With parents/guardians)

- Everything is included so there's no stress. It's also catered (inclusive pre-paid meal card) so don't need to worry about food or preparing food either. It's modern, clean, WiFi [is] excellent and facilities are superb. I would not get the same level of comfort or value for money via private accommodation. Plus it's Welsh speaking/bilingual too. (Uni halls)

- I love it [because] it has a gym so it saves me on paying gym fare and it has 24/7 security. Also right in the city centre so easy access to a lot of clubs, restaurants, supermarkets, etc. (Private halls)

- The rent is cheap and the house is lovely but it's riddled with mould and our landlord ignores us. (Private landlord)

Is student accommodation affordable?

As we mentioned, around one in 20 students have already faced eviction in the past. But even for students who haven't reached the point of being in rent arrears and/or losing their student accommodation, it can still be a huge struggle.

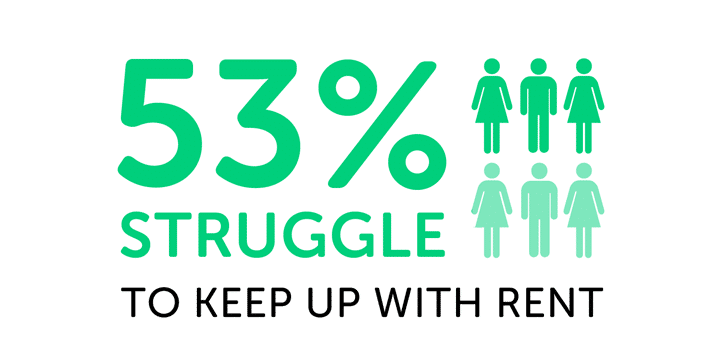

53% of students that pay rent said that they have struggled to keep up with the cost of it. When this stat is broken down, 11% found it a constant struggle, while 42% said they struggle from time to time.

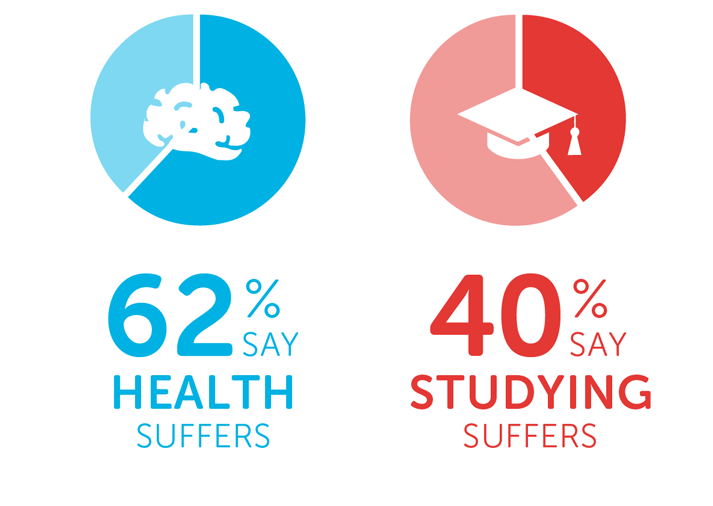

For too many students, worries about accommodation costs are affecting their studies and their health.

In particular, some students told us about the impact that accommodation costs and issues have had on their mental health:

- Physically and mentally, my health has struggled due to the cost and not being able to have heating or hot water. It's not a nice place to live and with how COVID has changed everything, we were not given any kindness or understanding. I have a terrible immune system and having no heating on all day in a cheap house is really hard. (Private landlord)

- As an estranged student, it is really difficult to afford all the living costs and socialising at the same time. It heavily impacts my mental health and definitely creates a feeling of alienation in comparison to my lucky peers whose rent is paid by their family. (Uni halls)

- My rent is so cheap for what facilities I have. If anything, my mental health benefits from this. (Private halls)

- Constant worry and anxiety over ability to pay on time if at all! (Private landlord)

How is the rising cost of energy bills affecting students?

With 53% of students already struggling with the cost of rent, the rising price of energy is adding to an already challenging situation for many.

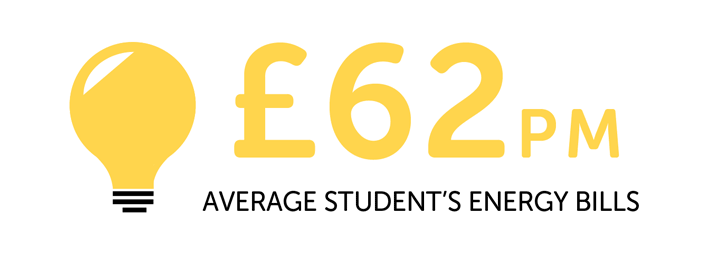

As we mentioned earlier, 40% of students in the survey need to pay at least some energy bills on top of their rent. These students are paying an average of £62 each per month on energy.

From this, we're able to calculate that the average cost of energy bills per student household is £220 per month.

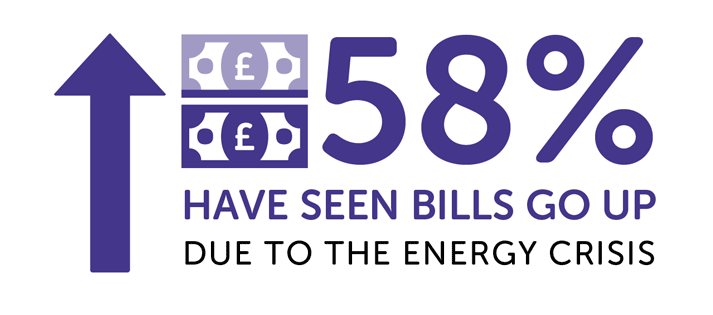

But, as has been widely covered in the media, the cost of energy is rising.

The increasing energy prices have already contributed to some providers going out of business. 18% of students in the survey that have energy bills set up said that they've been with an energy provider that has gone bust so far this academic year.

Four in five students in the survey who have energy bills are worried about the rising costs. On top of this, around three in five have seen their energy bills increase due to the rising prices.

It's already having an impact.

Three-quarters of students in the survey who don't have energy bills included in rent said they've had to cut back on heating due to how much the bills cost.

As well as this, we were alarmed to hear that many students anticipate needing to spend less on groceries, socialising, travel and more due to the rising cost of bills.

Among students in the survey who don't have bills included in rent, these are the areas of spending they expect to cut back on to pay for bills:

| Spending category | How many will cut back on spending |

|---|---|

| Takeaways and eating out | 62% |

| Clothes and shopping | 57% |

| Socialising | 54% |

| Holidays and events | 46% |

| Groceries | 43% |

| Travel | 42% |

| Gifts and charity | 33% |

| Study materials | 29% |

| Health and wellbeing | 24% |

| Mobile phone | 21% |

| None | 10% |

The government's support package

When students are anticipating spending less on food to keep up with bills, the issue is evidently urgent. Yet, as we mentioned earlier, the government's support package severely overlooks students' financial struggles.

Offering the £150 rebate to households in England in council tax bands A–D excludes full-time students, as they're exempt from paying council tax.

The government highlights in this article that the rebate is intended to help households with the rising cost of bills. Many full-time students are faced with these increasing costs. But, as they don't qualify for the £150 rebate, our calculations have led us to estimate that they're missing out on over £40 million of support.

This in itself is a massive blow to students. But it is more concerning still that the £200 bills credit in October could cost many students more money than it saves them.

For students who have bills included in rent, the bills credit won't benefit them, but many will still need to pay it back. This will particularly affect the 92% of students in uni halls that have bills included, as well as the 86% in private halls that do. Even those who don't have bills included in rent might live with fewer housemates after graduating, and could therefore repay more than they save.

We estimate that, overall, current undergraduate students will end up paying around £60 million more than they'll save through the £200 credit.

Of course, there is the discretionary funding of £144 million for vulnerable people and those on low incomes that don't pay council tax, or who pay council tax for properties in bands E–H. However, this funding is by no means guaranteed to students, highlighting that they have been left as an afterthought with this support package.

Here's what students say about the rising cost of bills:

- The rise in energy bills is seriously affecting our use of belongings. Everything has to be cut short. (Private halls)

- Heating bills cause me a lot of anxiety. (Private landlord)

- Although my bills are included with rent so I don't need to pay for them, I am still aware and anxious [about] energy bills rising for when I do have to pay in the future and it makes me take notice of how much I am using the heating, etc. (Uni halls)

- Our energy bills have increased from approx. £90 – £95 to over £130 despite being consistently below our monthly estimates for the past two years. (Private landlord)

- I was stunned when we had to pay our bills. The agent told us an estimate of £25 each month for the each of us. It's really high and that will by the reason for us moving to a different accomodation, even though the rent is ok, the bills are just too much. (Private landlord)

How students pay for their rent

Do students need to borrow money to cover the cost of rent?

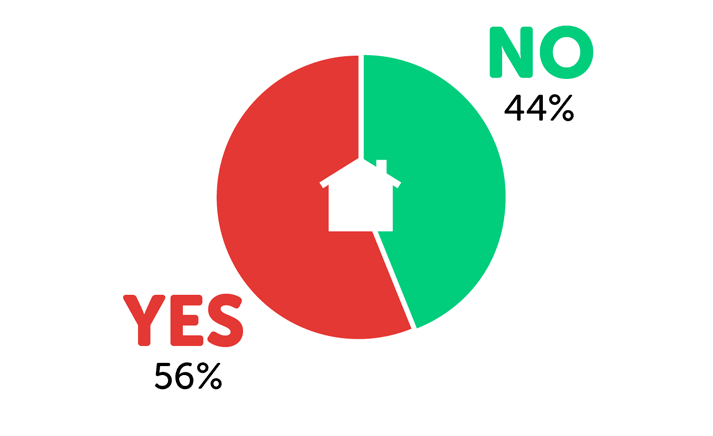

The proportion of students saying they need to borrow money to pay rent has noticeably increased since our 2021 accommodation survey, up from 47% to 56%.

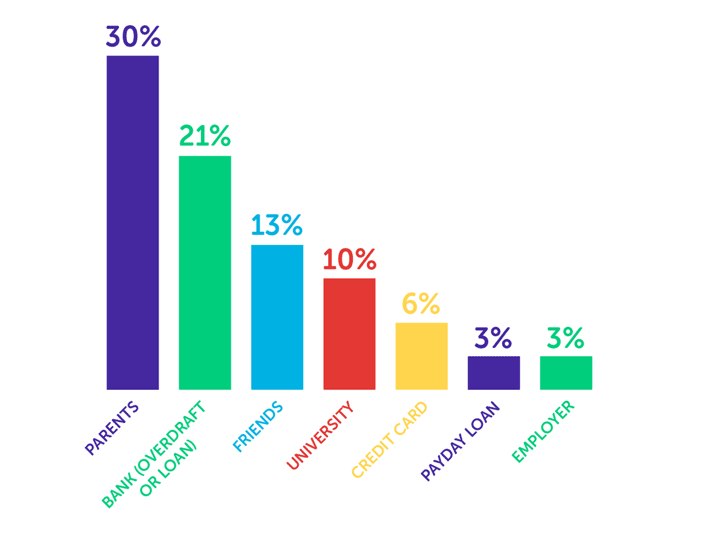

Looking specifically at where students are borrowing money from, parents are the most common source of funding:

Last year, we saw a dip in the proportion of students borrowing money through credit cards to cover the cost of rent, down from 6% in 2020 to 3% in 2021. This year, the figure has risen back up to 6%.

Another noticeable shift has been in the proportion of students turning to their university for money to keep up with rent. In both our 2020 and 2021 accommodation surveys, a consistent 7% said they received money from their uni for rent.

With it now up to 10%, it's possible that a growing proportion of students are aware of the support available from their universities in the form of hardship funding.

In May 2021, Universities Minister, Michelle Donelan, told us that the government had given universities more money to go towards hardship funding. This too could have played a part.

How much do parents pay?

Each year, students are receiving an average of £44 per week (£2,288 per year) from their parents to go towards rental costs.

Clearly, the cost of term-time accommodation impacts not only students, but often their families too. As living costs rise, the burden on both students and their parents could worsen.

We've heard from a number of students in the survey who expressed feeling guilty and worried about relying on their parents' help to cover the cost of rent:

- I worry about borrowing money from my parents. It makes me feel bad about myself. (Uni halls)

- Although my mum pays, I feel constantly pressured to look for the cheapest things to incur less cost for her. I worry about putting financial strain on the family and none of my flatmates are responsible enough to budget so it falls to me. (Private landlord)

- I feel guilt being indebted to my parents. (Private halls)

- My parents pay my rent and even though they offered, I feel bad for not being able to contribute. (Private landlord)

- My parents pay for it but I’m worried because I know it's a burden on them, especially with the exchange rate. (Private halls)

What issues do student renters face?

On top of the pressures of keeping up with rent and bills, students experience shocking housing issues which can take a long time to get resolved by their landlords. In some cases, the issues don't get resolved at all.

In the survey, we asked students about issues they've experienced with housemates and with the properties they live in. Here's what they said.

Biggest problems with housemates

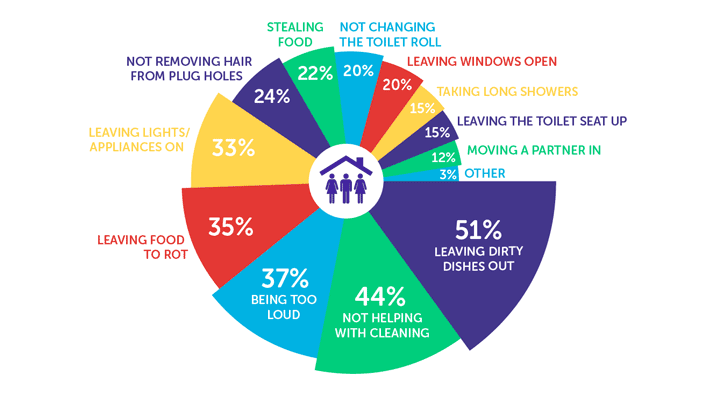

Just over half of students in the survey have had issues with their housemates leaving out dirty dishes – around a third have even seen food being left out to rot in their accommodation.

On top of this, 44% have been concerned about others in their household not helping with cleaning, while 37% have struggled with loud housemates.

Living with difficult housemates? Our guide to surviving shared living will help.

Biggest problems with properties

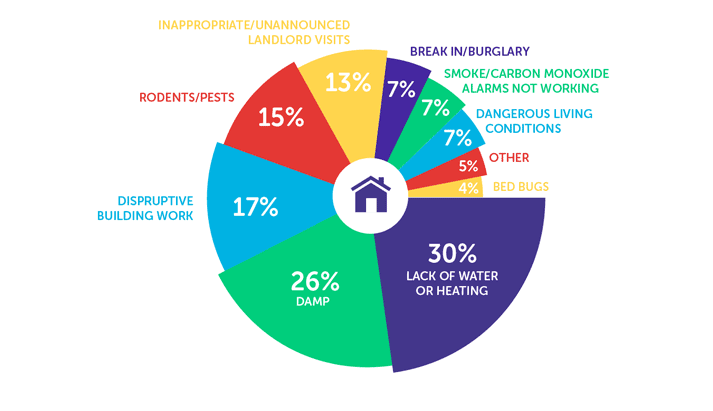

The two most common housing issues for students is having no water or heating (30%) or damp (26%).

However, it's also very worrying to hear that 13% of students in the survey receive inappropriate or unannounced landlord visits, while 7% have had a break-in or burglary.

On top of this, 7% have experienced dangerous living conditions, and an equal proportion have also had a broken smoke or carbon monoxide alarm.

Like all tenants, students deserve to live somewhere that's safe. It's shocking to hear that, for too many, this isn't always the case.

We've heard a number of worrying stories from students about their accommodation. Here are some examples:

- [We] had no heating or hot water or even clean water ([the] filter in [the] boiler wasn't changed for months) and the house was freezing and we were all ill for a while and couldn't get better as it was so cold. [Also] our washing couldn't dry so it created a damp atmosphere which made it worse. (Private landlord)

- We can't request help over the weekend so had a sink that was slowly flooding our cupboards and kitchen that we couldn't stop. (Private halls)

- My 2nd year house was awful. I had bed bugs, like woodlice, in my bed and had to buy my own bed. When I moved in, nothing had been cleaned, there [were] pizza slices on the floor. The cellar flooded when it rained, and it was carpet. The landlord wouldn't resolve any of the many (many more) issues so we wrote them on the chalk board so when people came for viewings, they could see all the issues that hadn't been resolved. Even then they didn't get resolved, so we moved out. (Private landlord)

- Bed bugs, mould, everything is dirty and broken. (Uni halls)

- Our landlord hasn't dealt with our silverfish issue. (Private landlord)

How long does it take to get problems sorted?

For students in the survey who have experienced issues with their accommodation, 28% have found that it can take over a week for the problems to be resolved. This includes 6% who said their issues aren't fixed at all.

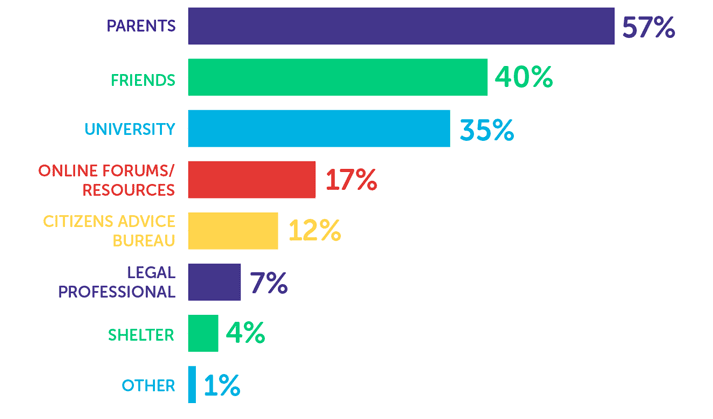

When students experience problems with their accommodation, this is where they turn to for advice:

Is student housing worth the spend?

Given the numerous issues we've explored in this survey, it's disappointing but perhaps not surprising that 35% told us they do not view their accommodation as good value for money.

While this is much higher than we would hope to see, one positive finding from the survey is that this figure has dropped from last year, when 47% of students had said the same. As the pandemic is now having much less of an impact on students' living situations, this has likely led more to view their accommodation as good value for money.

However, there is still a long way to go to ensure that all student renters live in properties that are safe, warm and worth the money that they spend.

What do the experts say?

Save the Student

Jake Butler, Save the Student's money expert, says:

The cost of accommodation is already a huge drain on students' finances and as we can see from our latest insights, the situation is unfortunately set to get a lot worse.

The government has offered help but the vast majority of students won't be able to access it. In the case of the £200 rebate, it's actually likely many will end up paying it back over the next five years despite never having the advantage of the saving in the first place. How can that be fair?

This is all on top of the ongoing issue that the Maintenance Loan, which is intended to help students cover living costs like this, was not enough, even before the spiralling increases in the cost of living.

Alongside the alarming rise in energy prices, we conservatively estimate that the amount of support that current students are set to miss out on will be over £100 million. I am calling on Rishi Sunak and the Universities Minister, Michelle Donelan, to outline what they plan to offer to, what seems to be, a forgotten sector of our society.

NUS

Hillary Gyebi-Ababio, NUS Vice-President for Higher Education, adds:

This important report shows just how broken the student accommodation system is.

NUS know from our own research into student accommodation costs that rents have increased by 61% in the last decade. They now take up almost three quarters of the maximum loan available to students and are considerably more expensive than the average loan.

Save the Student have shown clearly that the student rental system is broken. We are past the point where students are even close to affording this which is why we're pursuing widespread change both through rental reform and supporting grassroots student-led organising. Like the broader education system, nothing about this failing marketized model is inevitable.

Student housing resources

These guides include info or advice about many of the topics covered in this report:

- Student rent calculator

- Parental contribution calculator

- National Student Money Survey

- How to save money on rent

- 8 things to check before signing a tenancy agreement

- Moving house checklist

- Managing debt at university.

About the National Student Accommodation Survey 2022

Want to know more about the survey, or need case studies, comments or quotes? We're happy to help – just drop us a line.

You're welcome to reference or re-use data from the survey with credit and a link back to the site: "Source: The National Student Accommodation Survey 2022 / www.savethestudent.org"

The survey polled 1,245 students in the UK between 6th January 2022 and 3rd February 2022.

Our estimate that current students could end up being over £100 million worse off compared to those eligible for the full support package is based on results from this survey and HESA data.